If you’re like most people, you aren’t eager to spend time thinking about what would happen if you became unable to direct your own medical care because of illness, an accident, or advanced age. However, if you don’t do at least a little bit of planning — writing down your wishes about the kinds of […]

Have YOU made a Will?

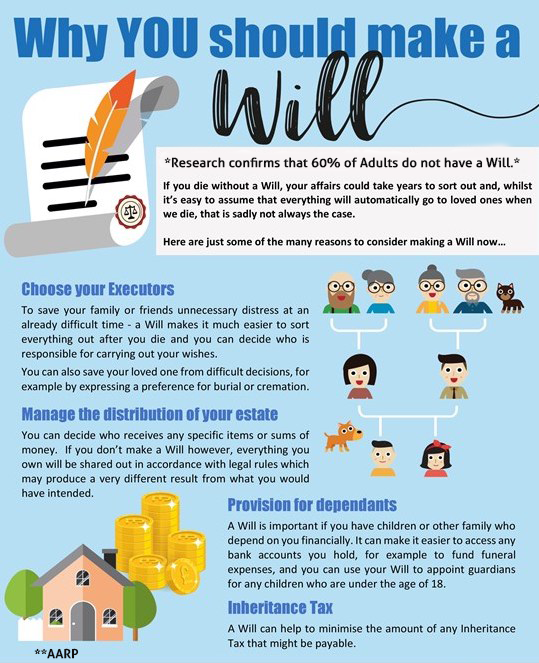

If you haven’t made your Will yet, you are not alone. Research indicates that 60% of Adults do not have a Will.

There may be many reasons why you haven’t made a will – whether you think you’re too young, think it’s too expensive, or think that you have nothing to pass to your family, or think that it will automatically pass to your family.

The reality is that everyone needs a Will.

It is especially important if you have children, own property or have a business. It is also imperative to make a Will or to review any existing one if you are divorced, get married or when buying or selling property, or when anyone named in your existing Will is no longer with us.

Without a Will, there can be problems for your loved ones.

Making a Will is not difficult and it ensures your possessions go to the right people after your departure.

You can use a Professional, or go the DIY route if your personal situation and estate are not complicated. If you choose the later, keep reading for the 3 DIY options:

1. Use an Online Will Template

If you google “how to make a will” or “will templates” in your browser, you will find many sites offering templates.

Pros:

- Many sites offer FREE templates tailored to your state’s regulations and your personal needs

- You can complete your will on your own schedule

Cons:

- Templates could be outdated. Double-check current laws to make sure the one you’re using is valid.

- Some template providers require you to register or enter personal information. If you’re concerned about privacy or future sales calls, this could be a problem.

2. Use Will-Writing software

Your online search will probably also turn up software such as programs offered by Rocket Lawyer or LegalZoom. These sites guide and direct you through the process more than a template does.

Pros:

- The software should include your state’s legal requirements

- The standardized language that programs use helps to remove any confusion about your wishes

- A guided approach helps ensure you don’t overlook any information or steps

- As with a template, software lets you write your will when it’s convenient for you

Cons:

- The Software isn’t free, although it’s generally cheaper than hiring an attorney.

- You will need to research online reviews and other resources to find reputable software.

- These Programs may not account for special circumstances, such as naming someone to watch over a prized collection.

3. Go the Combo Route

With this option, you start writing your will yourself, (using either a template or software), and then ask an attorney any lingering questions.

Pros:

- By starting the process, you’ll have answered or anticipated most questions a legal adviser would have

- You’ll be able to discuss your concerns with a professional — and learn about concerns you might not have considered

- Because you’ll have done much of the work before consulting the attorney, your fees might be much lower than what you’d have paid if you started with a visit to the lawyer’s office

Cons:

- Even a Partial Lawyer’s Fee is more expensive than the other Will Writing methods. If your Budget is tight, you my want to do as much pre-work up front, and discuss your budget with them at your first meeting.

- Working with a professional is more time-consuming. You’ll have at least one appointment at the attorney’s office, which might mean taking time off work.

Regardless of the method you choose, the most important thing is to complete the process. Virtually any kind of will is better than none. Remember, too, that you’ll need to update your will, either on your own or by contacting your attorney, whenever your life circumstances change (such as having a child or getting divorced).

If your estate is complex or large, it might be worth your time and money to consult an attorney right away. If your estate is smaller, then the DIY route may be the best option for you.